costa rica income taxes

This regulation is essential for the tax legislation of that country since under this law Costa Rican. Corporate income tax CIT due dates.

Costa Rican Taxes For U S Expats 8 Things To Know About Tax Returns

The new brackets are for corporate income income from profitable activities and the salary tax.

. Costa Rica Income Tax for Wages Fixed Salary Taxable Monthly Income CRC Costa Rican Coloncurrently 525 to 1 US. Directorate General of Taxation of Costa Rica. Costa Rica income tax rates are progressive between 0-25.

The following figures refer to annual salaries. Costa Rican income tax is payable on any income that is generated in Costa Rica for residents or non-residents. Income taxes in Costa Rica apply only if you generate an income from your Costa Rican business or.

However it has been reformed throughout time being one of the last modifications made by the Public Finance Strengthening Law. Fees for filing personal income taxes start around 1000. Tax Rate Taxable Income Threshold.

The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income. On December 23 2021 Costa Ricas Tax Authority published Executive Decree No. Corporate income is taxed at a 30 rate.

Personal Income Tax Rate in Costa Rica is expected to reach 1500 percent by the end of 2020 according to Trading Economics global macro models and. For self-employed rates range from 10 to 25. For residents of Costa Rica salaries and self-employment.

Review the 2021 Costa Rica income tax rates and thresholds to allow calculation of salary after tax in 2021 when factoring in health insurance contributions pension contributions and other salary taxes in Costa Rica. A resident for tax purposes is anyone who spends more than 183 days including part days in Costa Rica in a year. The following corporate income tax rates will apply to the income of companies.

Detailed description of taxes on corporate income in Costa Rica Quick Charts Back. The tax year in Costa Rica is the fiscal year running from October 1 to September 30. 7 rows Income taxes on individuals in Costa Rica are levied on local income irrespective of.

The Income Tax Law was introduced to the Costa Rican tax system in 1988 through Law No. The brackets went into effect January 1 2022. The Personal Income Tax Rate in Costa Rica stands at 15 percent.

When a property is purchased it must be transferred into the purchasers name. The Costa Rican tax system is unlike any in the world. Tax Year In Costa Rica And Tax Filing And Payment Rules.

Income tax on wages and income tax on profit generating activities. 30 for companies with gross income over CRC 112170000. With areas like capital gains entirely exempt from taxes and mechanisms such as an SA.

For this category the following rates apply. 43375-H which contains the income tax brackets applicable for tax year 2022. Income Tax Law in Costa Rica.

Every person working in Costa Rica must pay a monthly withholding tax based on his her salary. The Costa Rican income tax rate varies based on what type of income you receive. However the law establishes special regulations for small companies whose gross income does not exceed 112170000 Costa Rican colones CRC.

Residents pay Costa Rican income tax at relatively low rates on a scale of 1 to 25. Dividend and interest income are generally taxed at 15 while most capital gains are exempt from taxation. Corporation arrangement to avoid some tax liability there are a number of intricacies to the system that can help you achieve your business and investment goals more efficiently.

DollarExchange rate fluctuates often. Generally speaking Costa Rican taxes run anywhere from 10 percent to 15 percent of annual income after all of the exemptions and deductions are factored into the equation. Income from employment monthly of individuals is taxed up to 15.

There are 2 different types of income taxes in Costa Rica. Costa Rica Tax System Income Taxes. Paying Costa Rican Taxes.

The Costa Rican sales tax is. Unlike the United States and other countries large. Costa Ricas income tax.

Corporate income tax CIT rates. The income tax scheme is graduated meaning that those who earn more are placed into a higher tax bracket. Costa Rica requires taxpayers to pay taxes on income earned within Costa Rica.

In Costa Rica income tax rates are progressive. Up to 2747000 CRC.

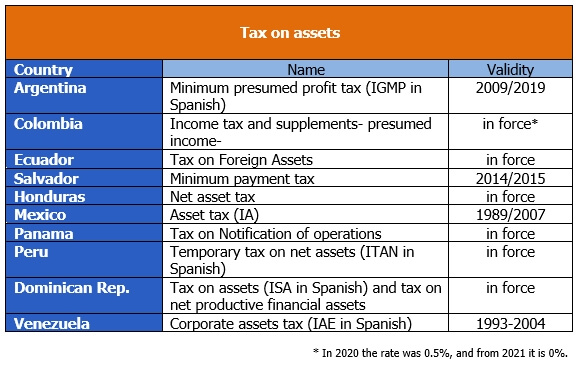

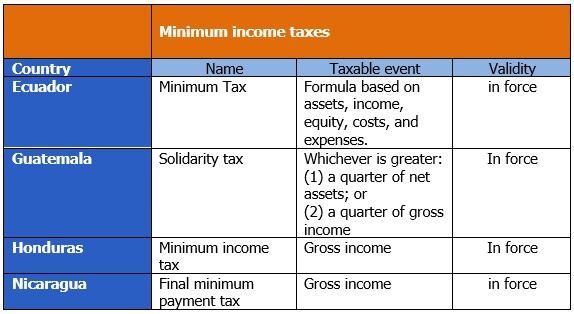

Income Tax Minimum Tax Inter American Center Of Tax Administrations

Income Tax Minimum Tax Inter American Center Of Tax Administrations

Tax Checklist For Canadians Tax Checklist Tax Prep Checklist Canadian Money

When The Income Tax Department Raids Your Place

![]()

Inactive Companies Must File A Tax Return By March 15 2022 Costaricalaw Com

Pin By Bv Consultores On Sistema Atv Ministerio De Hacienda Costa Rica

Inactive Companies Must File A Tax Return By March 15 2022 Costaricalaw Com

2022 What You Need To Know About The 13 Vat Tax In Costa Rica The Official Costa Rica Travel Blog

Pin On Sistema Atv Ministerio De Hacienda Costa Rica

Top 10 Tax Havens Around The World Tax Haven Income Tax World

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Costa Rica Rental Income Taxes Special Places Of Costa Rica

10 Tax Tips For U S Citizens Living In Costa Rica In 2021

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Costa Rica Company Filing Obligations For 2022 Costaricalaw Com

Honduras Personal Income Tax Rate 2021 Data 2022 Forecast 2004 2020 Historical

Florida Beautiful Beaches No Income Tax Less Regulation More Sunshine Beautiful Beaches Florida Funny Income Tax

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire